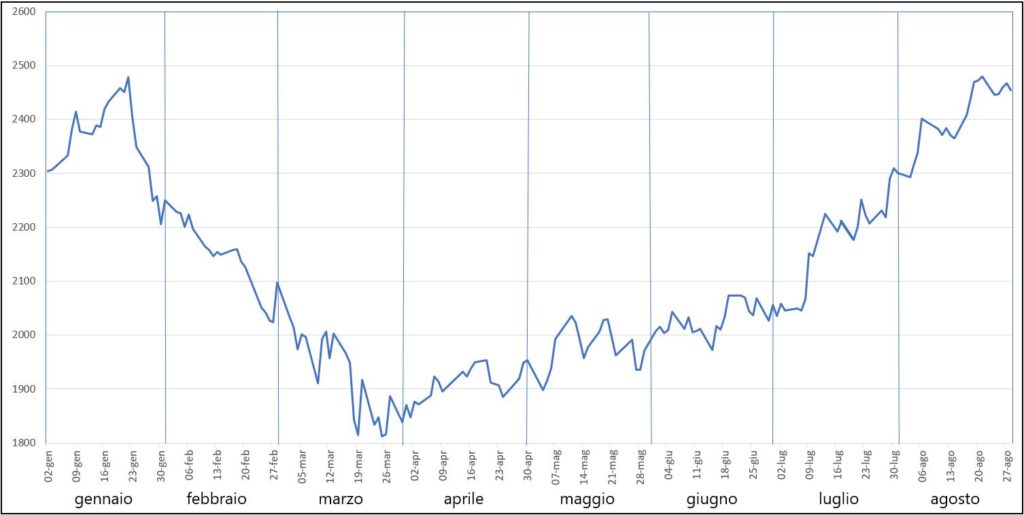

Contrary to past years, when zinc prices cooled in August due to reduced seasonal activity, this year the opposite occurred. As per the following graph, the price of zinc at the LME in London, expressed in dollars / ton, it closed the month of July with a strong recovery, returning to the levels of the end 2019 and, in August, has maintained the trend of continuous growth.

Spot quotes, which until February were higher than those at term, they gradually weakened in favor of the Contango (prices a 3 months higher than cash prices), which has gradually widened until it reaches a differential of +24 $/tonne, as evidence that investors have injected liquidity into the system, in view of a recovery in demand.

By the end of July, prices had hovered above 2.300 $/tonne, after recording a 12% progress in June. The growth trend continued in August and, at the end of the month, prices recorded the value of 2.455 $/tonne, with an increase of 7% on the previous month and of 19% on June.

During the lock down period, prices had dropped in late March to 1.870 $/tonne, leaving the 17% compared to the value recorded at the end of January.

Ma, saw that the question, except China, is sluggish, the deficit that had dominated the scene until 2019 gave way to the surplus of 170.000 tons and stocks have grown at the LME up to 224.000 tons, because zinc prices tend to rise?

Given that, among the base metals, Zinc is the one that has the best prospects for recovery, it must be considered that the greatest stimulus comes from China which, as everyone knows, covers the 50% of world consumption. This country came out of the pandemic earlier than the others, while the rest of the world continues to suffer from the effects of Covid-19.

Mining production in Bolivia and India collapsed as a result of the pandemic, while other miniatures in Alaska suffered closures due to technical problems.

The market is still pervaded by uncertainty, but some hint of optimism comes from the fact that, on the London stock exchange, quotations a 3 months are higher than those for cash's 22-25 $/tonne. This is an index that the market, so far illiquid, it begins to attract capital from institutional funds which are more active in the short term.

The general impression of the technicians is oriented towards a slightly positive trend because it is true that there is an abundance of Zinc but on the other hand, buyers are "short" and therefore have to replenish stocks.

As for Italy, the demand is weak but the sales premiums, pari a 140-145 $/tonne, they are higher than those of Northern European countries, which are approx 70-80 $/tonne.